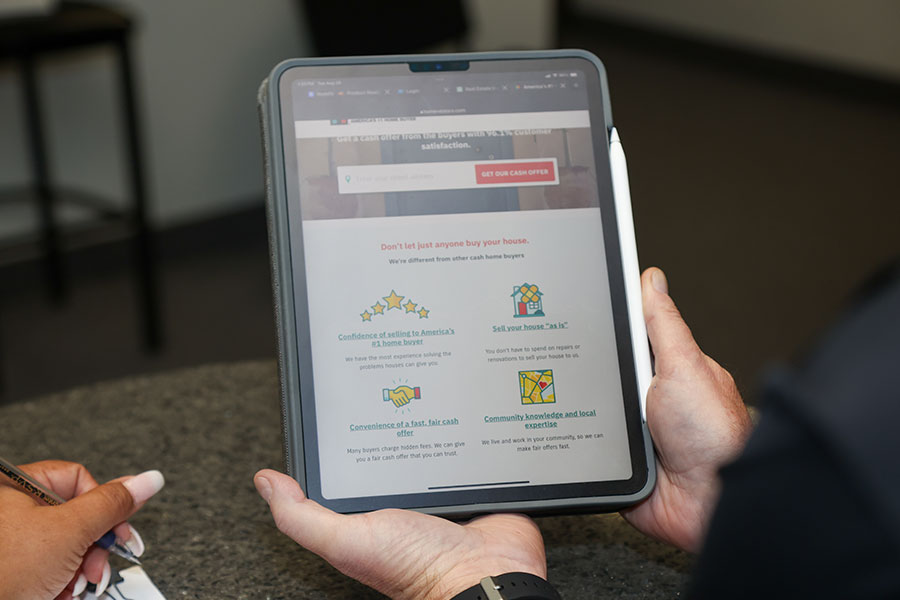

Start your business in

as few as 60 days!

as few as 60 days!

0+

Years of Experience

0K+

Houses Purchased

0%+

Customer Satisfaction *

Foundational Insights Blog

Stay informed on industry trends, get the latest HomeVestors® news and get advice from our experts with decades of collective home buying and investing experience all across the nation.

Chandra Quaye

Kyle Amerson

Franchisee Testimonial

“I believe we’re perfectly positioned as HomeVestors® franchisees to capitalize on opportunities because we have the contacts. We have established title company relationships. We have established relationships with the municipalities. But, specifically, we have relationships with contractors—they love to work with us. They know us and we know them. That’s the bottom line.”